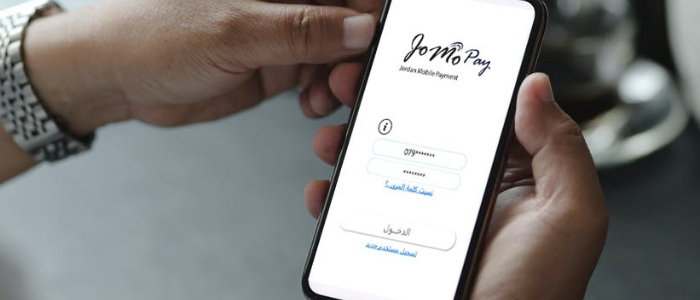

All you need to know about JoMoPay e-wallets

JoMoPay is the main provider for e-wallet systems provided by the Jordan Payment & Clearing Company - JoPACC - under the supervision of the Central Bank of Jordan. The application was established in 2014 as a response to the local market needs to facilitate and speed up payment processes through mobile applications.

The demand for e-wallets has increased significantly with the rise of the emerging Coronavirus crisis, especially that the quarantine encouraged companies to adopt e-wallets as means to pay salaries and obtain financial support from the Jordanian government. This high demand brought up the number of e-wallets activated during March and April to 443,095 wallets.

PointCheckout gathered all the information you need to know about the JoMoPay e-wallets before you start using it.

How to open a JoMoPay e-wallet?

JoMoPay is the main provider of approved e-wallets in the Hashemite Kingdom of Jordan. In order to open a wallet, users must download one of the approved e-wallets that operate within the JoMoPay system, such as Zain Cash, Dinarak, Orange Money, the National Wallet from MEPS, Uwallet, AyaPay and Gadha.

Users can open an electronic wallet free of charge without depositing any minimum amount through one of the above-mentioned service providers.

Find out all the details of Zain Cash from here

Moreover, users can open two electronic wallets, provided that each one is linked to a different phone number as the e-wallet number is the same as the mobile number.

To open the electronic wallet, customers must download the application from the desired service provider, visiting the designated website or at any of the authorized agents. In addition to that, customers can open a wallet through the applications with the banks participating with JoMoPay, such as The Housing Bank, Arab Bank, Bank of Jordan, Cairo Amman Bank and Jordan Commercial Bank.

How to charge the JoMoPay e-wallet?

There is a long list of partners approved for charging e-wallets, from Exchange service stores, post offices, telecommunications companies, supermarkets and some mobile stores. View the full list here

Furthermore, it is also possible to deposit in the e-wallet or recharge via eFawateer.com or through the ATMs of the Jordan Kuwait Bank or Cairo Amman Bank.

The operations that can be performed with JoMoPay approved e-wallets

Transfer money through e-wallets

Users can transfer funds from one e-wallet to another, regardless if it is a company, merchant or individual "personal wallet" account. For example, companies can transfer salaries to employees’ electronic wallets, furthermore, individuals can transfer money to the merchant's wallet to pay for specific service or product.

In order to transfer funds, users need to add the number of the recipient and the amount to be transferred.

Pay through Point of Sale (POS) devices using Near Field Communication (NFC) technology

Payment can be made at any store or place that accepts payments through POS via NFC technology. The technology uses a smart sticker for remote payments, the wearable watch, or the electronic wallet card issued by the service provider. The e-wallet card can also be used to make Internet purchases.

Cash withdrawal from an ATM

This feature is still under development as ATM withdrawals are limited to Jordan Kuwait Bank and Cairo Amman Bank regardless if the user has a bank account, note that the withdrawal commission varies according to the service provider.

Customers can withdraw cash by visiting one of the agents approved by the service provider.

Pay bills

In cooperation with eFawateercom, e-wallet owners can securely pay their electricity, water, and phone bills, in addition to paying taxes, fines and recharge pre-paid phones.

Mobile payments using USSD messaging service

Customers who do not have a smart phone can transfer money and withdraw money from ATMs using the secure messaging service USSD.

Transaction ceilings on JoMoPay e-wallet services

The ceilings for transactions in electronic portfolios are determined by the Central Bank of Jordan as follows:

Note that each service provider has different transaction fees, as per below:

Customers can open their e-wallet, issue a supplementary card, and the deposit free of charge, similarly, there are no extra charges for money transfer, payment of bills, purchases or closing of the wallet.

National wallet by MEPS

All services provided through the national wallet are free of charge except cash withdrawal services from agents which entails a 1 JD commission.

Read all the details about the National Wallet from the Middle East Payment Services Company (MEPS)

Dinarak wallet

Services such as opening a wallet, depositing, transferring money, settling bills, purchases and closing e-wallets are all free at Dinarak. Transactions that charge extra fees are the following:

Aya.jo wallet

There are no extra charges on any of the e-wallet services provided that the withdrawal is made from the Jordan Kuwait Bank ATMs.

Gadha wallet

Services such as opening a wallet, depositing, transferring money, settling bills, purchases and closing e-wallets are all free at Gadha. Transactions that charge extra fees are the following:

Zain Cash Wallet

Services such as opening a wallet, depositing, transferring money, settling bills, purchases and closing e-wallets are all free at Zain Cash. Transactions that charge extra fees are the following: